Wealth, like a fleeting breeze, comes and goes in the journey of a person’s life. The impermanence of wealth is a fundamental truth that underpins financial realities. Throughout our lives, we experience the ebb and flow of financial fortunes, witnessing moments of abundance and periods of scarcity.

External factors such as economic trends , market fluctuations, and unexpected events influence this transience. Embracing the impermanence of wealth requires a balanced mindset, resilience, and adaptability.

By recognizing the fleeting nature of financial prosperity, we can make informed decisions, build a secure financial foundation, and foster a deeper understanding of the true value of wealth in our lives.

I. Understanding Wealth Transience

Financial success is not a constant destination; rather, it ebbs and flows in the life of an entrepreneur. Understanding the transience of financial success is crucial for entrepreneurs as it prepares them for both ups and downs in their business journey.

Being aware of this impermanence helps entrepreneurs stay grounded during prosperous times, making wise decisions and avoiding complacency. Simultaneously, during challenging periods, this awareness provides the resilience needed to persevere, innovate, and bounce back stronger.

Embracing the impermanence of financial success empowers entrepreneurs to stay focused, adapt to changing circumstances, and maintain a long-term vision for sustainable growth.

The effect of Covid 19

The COVID-19 pandemic has inflicted significant blows on businesses in Singapore, leading to economic challenges and downturns. According to the Ministry of Trade and Industry (MTI), Singapore’s economy contracted by 5.4% in 2020, the worst downturn since independence.

Various sectors experienced severe disruptions, with retail trade plummeting by 6.8% and accommodation and food services dropping by a staggering 23.8%. The pandemic’s impact on international travel resulted in a substantial decline in tourism revenue, leading to a 78.4% decrease in the number of international visitors.

These statistics highlight the harsh reality of how COVID-19 has adversely affected businesses in Singapore, requiring concerted efforts for recovery. This has taught many individuals that one cannot always expect financial stability.

II. Factors Influencing Wealth Fluctuations

A. Economic Trends and Market Volatility

Global economic fluctuations are a testament to the unpredictability of the world’s financial landscape. Markets experience ebbs and flows, driven by a multitude of factors such as geopolitical events, technological advancements, natural disasters, and pandemics.

These fluctuations can lead to rapid shifts in currencies, stock prices, and trade balances, affecting businesses and individuals worldwide. While economists analyze patterns and trends, everything remains uncertain.

The COVID-19 pandemic is a poignant reminder of how unforeseen events can disrupt economies on a global scale. As such, businesses and policymakers must remain agile and adaptable to navigate the ever-changing economic currents and mitigate the impacts of unpredictability.

B. Global Events and Their Impact on Wealth

Major global events have an inevitable and profound impact on the financial stability of people worldwide. Whether it’s economic crises, natural disasters, pandemics, or geopolitical tensions, these events can disrupt economies, lead to job losses, and cause financial uncertainty.

Accepting the inevitability of such events empowers individuals to be proactive in financial planning, building peservearance, and diversifying investments. Recognizing that unforeseen challenges are part of the global landscape allows individuals to make informed decisions, adapt to changing circumstances, and safeguard their financial well-being amidst uncertain times.

Here’s a list of some of the major global events that has resulted in financial markets to crash and cause financial instability in many countries:

– 2008 Global Financial Crisis: Triggered by the collapse of Lehman Brothers, causing a severe credit crunch and economic downturn worldwide.

– Dot-com Bubble (2000): Bursting of the internet bubble led to significant losses in technology stocks and impacted global markets.

– Asian Financial Crisis (1997): Currency devaluation in Asian countries, affecting the global economy.

– Oil Price Shock (1973 and 1979): Sudden increase in oil prices caused economic recessions and inflation globally.

– Great Depression (1929): The stock market crash led to a prolonged worldwide economic downturn, affecting all sectors of the economy.

– COVID-19 Pandemic (2020): This led to lockdowns, business closures, and disrupted global supply chains, causing a severe global economic recession.

III. Coping with Financial Loss and Uncertainty

Coping with financial loss and uncertainty requires a combination of practical and emotional strategies. Here are some things that can be done:

- Establishing an emergency fund provides a safety net during unforeseen downturns

- Reevaluating financial goals and prioritizing expenses helps adjust to new circumstances.

- Seeking professional advice from financial experts can offer guidance and reassurance.

- Emotionally, fostering a positive mindset and practicing mindfulness can alleviate stress and anxiety.

- Learning from past experiences and adopting a growth-oriented perspective encourages perseverance.

- Engaging in continuous learning about personal finance builds financial literacy and empowers individuals to make informed decisions.

By combining these approaches, individuals can navigate financial loss and uncertainty with greater confidence and adaptability.

IV. Strategies for Long-Term Wealth Management

Long-term wealth management refers to a comprehensive financial strategy aimed at securing and growing wealth over an extended period. It involves setting realistic financial goals, creating a diversified investment portfolio, and regularly reviewing and adjusting the plan to align with changing circumstances.

Long-term wealth management focuses on,

- sustainable growth

- risk mitigation

- wealth preservation

- financial stability

- enables individuals to achieve their life goals

- provides a safety net during economic downturns

By taking a disciplined and proactive approach, long-term wealth management empowers individuals to build a strong financial foundation and enjoy a secure and prosperous future.

It matters for all professions

Across the landscape of the working world, be it the banking sector, home tuition service , or businesses, there is always a possibility that there will be downturns every now and then. Take for example a home tuition agency in Singapore.

Although they may have affordable tuition rates, it is not always a garuntee that home tutors with the best tutor profiles will always make a good earning or that tuition centres will always have the same demand from student population all along.

Tuition teachers need to understand though some might have the upperhand in the market (for example, experienced home tutors), odds can also be in one’s favour. Downturns are always there to teach us a good lesson. Implementing such lessons and assessment of mistakes will enable us to surpass our limitations.

V. Navigating Economic Turbulence

Global financial stability sounds like a rather utopian world. This is becuase economic growth will not be the same for all countries. Financial imbalances, struggling financial sector, and uncertainty in performance of emerging markets is part and parcel.

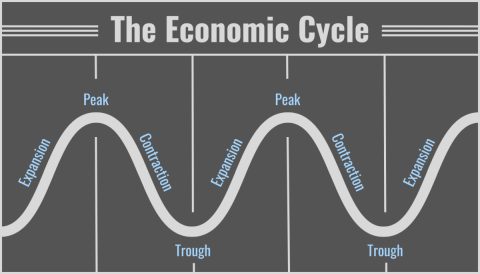

A. Understanding Economic Cycles and Trends

Understanding economic trends and cycles requires studying key economic indicators, such as GDP, inflation rates, and employment figures. Monitoring stock market performance and interest rates also provides insights.

Analyzing historical data and patterns helps identify recurring economic cycles, like expansions and contractions. Staying informed about global events and geopolitical developments is crucial, as they impact the economy.

Following reputable economic publications and reports, and seeking guidance from financial experts, aids in comprehending the complexities of economic trends and cycles, enabling individuals to make more informed financial decisions.

Conclusion

In conclusion, the transience and impermanence of wealth serve as constant reminders of the ever-changing nature of financial fortunes. The journey of handling financial loss and gain demands adaptability, resilience, and a mindful approach.

By embracing the reality of wealth fluctuations, individuals can prepare themselves to navigate the ups and downs of their financial lives with greater wisdom. Whether facing adversity or prosperity, the key lies in building a strong financial foundation, seeking knowledge, and making informed decisions to secure a stable and prosperous future.